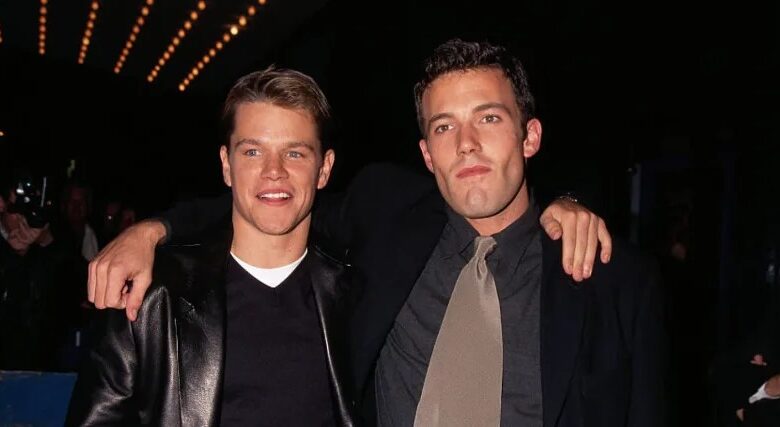

‘We were broke in six months’: Ben Affleck says he and Matt Damon blew through their Good Will Hunting paychecks on jeeps, ‘party house’ — here are 5 tips to make your money last

Hollywood star Ben Affleck recently revealed that he and close pal Matt Damon blew through their earnings from iconic 1997 film Good Will Hunting in record time.

“I was like, ‘We are now rich for life. ‘My needs are over. I will never have to work again,’” recounted the acclaimed actor and filmmaker — who now has over 60 film credits to his name — in an appearance on The Drew Barrymore Show.

The pair of then-20-somethings sold the film for $600,000 and split the cut. However, they each paid $30,000 to their agents and $160,000 in taxes — leaving them with $110,000 each.

So what did they do with their profits? Affleck and Damon decided to splurge on two $55,000 Jeep Cherokees, bringing them down to just $55,000 each.

“Naturally we decided to rent a $5,000-a-month party house on Glencoe Way by the Hollywood Bowl and we were broke in six months,” Affleck continued.

While they’ve both clearly landed on their feet despite their initial poor financial planning, here’s how to make your money last — even if you don’t have another Academy Award-winning project up your sleeve.

1. Budget wisely

First rule of thumb: Don’t drive through half your earnings for a new set of wheels. Affleck and Damon would have benefited from making modest purchases instead of splurging on a pair of Jeep Cherokees and a party house.

Make a budget — and more importantly — stick to it. Keep track of your monthly spending, whether that’s with a pencil and paper, an Excel spreadsheet or through an app.

First start off with your necessities, like groceries and rent, then set some cash aside for your debts and savings. Once you’ve got the basics covered, you can consider treating yourself afterwards.

2. Pay off any debts

After you create a budget, take care of the bills — whether they’re from your film agent or your credit card company.

Remember that credit card interest adds up over time, so it’s important to pay your monthly bill in full and on time each month. If you’ve got a stack of bills coming in, consider starting off by clearing your highest-interest loans first.

If you’re struggling to keep track of what you owe to who, you might consider rolling all your debts into a single loan with a lower interest rate, so that can save yourself some interest and only have to worry about one bill each month.

Read more: Your cash is trash: 4 simple ways to protect your money against white-hot inflation (without being a stock market genius)

3. Build an emergency fund

Even if you do end up going broke in six months, it’s helpful to have an emergency fund in place to provide some buffer until your next paycheck.

Most experts recommend having at least three to six months’ worth of savings set aside at all times to prepare for unexpected crises, like a big medical bill or a job loss.

Consider setting some cash aside into a high-yield savings account that comes with higher interest rates so you can grow your savings as well.

4. Save for retirement

When you’re young, your vision for retirement might still be a little hazy, but investing early is always better.

Do your research and pick out some safe, stable investments to start out with. If you’re not comfortable managing your portfolio on your own, consider trying out a robo adviser that’ll automate things for you.

Even if you can’t afford to set aside thousands of dollars for investment purposes, you can get started with just your spare change. And thanks to compound interest, those cents will add up to dollars over time.

5. Earn some passive income

Finally, instead of depleting your earnings, find simple ways to boost them on the side. Investing, especially on stocks with high-dividend yields, has long been a popular method of supplementing income.

But many people are put off by the risk involved in investing in the stock market before you can reap any rewards.

One lucrative alternative is real estate. In fact, prime commercial real estate has outperformed the S&P 500 over a 25-year period.

And now, thanks to new crowdfunding investing platforms, investors of all types can own a percentage of physical real estate — from rental properties to commercial buildings to parcels of land — with as little as $100 to invest.